If you are looking to invest in cryptocurrency, having a reliable cold wallet is a must. With so many options available on the market, it can be overwhelming to choose the best one for your needs.

In this article, we’ll cover what a cold wallet is and give you a rundown of the top seven cold wallets of 2024 that offer the best security for your money.

What Is a Cold Storage Wallet?

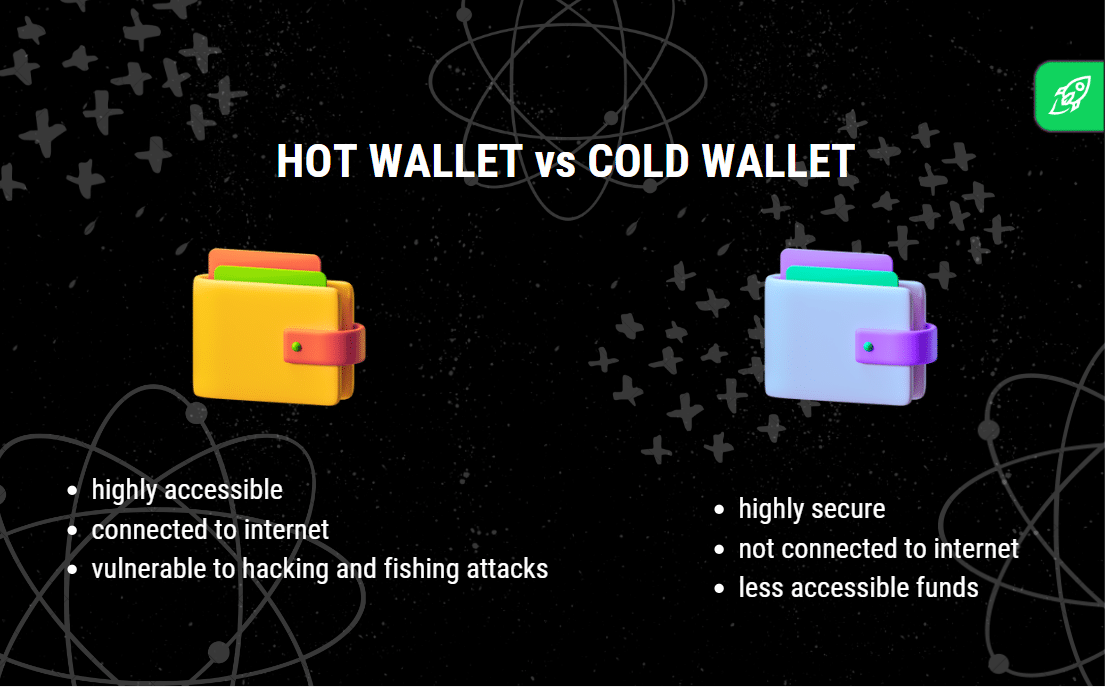

A cold wallet, also known as an offline wallet, is a type of crypto wallet that stores your digital assets without being connected to the Internet. This contrasts with hot wallets, which are always connected to the Internet and more vulnerable to hacks and cyber attacks. Cold wallets store private keys offline,offering enhanced security for your cryptocurrencies by keeping them away from online threats, significantly reducing the risk of theft.

Best Cold Wallets for Crypto: 7 Wallets Worth Getting

Now that you understand the importance of cold wallets for the secure storage of your digital assets, let’s take a look at seven popular crypto wallets worth considering.

1. Ledger Wallets

The Ledger Nano X is a premium hardware wallet designed to securely store over 5,500 cryptocurrencies. Its standout feature is Bluetooth connectivity, which allows seamless interaction with mobile devices, enabling users to manage their digital assets on the go via the Ledger Live app. This integration offers a user-friendly experience, especially when paired with popular wallet applications like MetaMask and Mycelium. The Nano X also includes a built-in battery for wireless use and supports up to 100 cryptocurrency apps simultaneously, making it ideal for users who want a versatile and mobile-friendly solution.

On the other hand, the Ledger Nano S is a more affordable option. It also supports over 5,500 cryptocurrencies but lacks Bluetooth functionality, requiring a USB connection to manage assets. The Nano S is perfect for those who prefer a wired-only option and provides high-level security by keeping private keys offline. However, it supports fewer cryptocurrency applications at a time—between 3 to 6—making it less suited for multi-asset management compared to the Nano X.

For users seeking more functionality than the Nano S but at a lower cost than the Nano X, Ledger offers the Nano S Plus, which increases app storage capacity and provides a more flexible solution without the premium features of the Nano X. Both devices, however, maintain the same high security standards that Ledger is known for.

2. Trezor Model T

The Trezor Model T is a renowned hardware cryptocurrency wallet celebrated for its robust security and user-friendly features. It supports over 1,000 digital assets, including major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA), as well as numerous ERC-20 tokens.

A distinguishing feature of the Model T is its vibrant, full-color touchscreen display, which enhances the user experience by simplifying asset management and transaction verification. Beyond securely storing cryptocurrencies, the device functions as a comprehensive digital identity tool, offering password management and Universal 2nd Factor (U2F) authentication. This versatility makes it invaluable not only for crypto investors but also for individuals seeking enhanced digital security across various platforms.

In terms of security, the Trezor Model T employs advanced measures, including PIN protection, recovery seed backup, and passphrase support, ensuring private keys remain secure and offline. Its compatibility with various software wallets adds to its appeal as a reliable and secure hardware wallet choice. The Trezor Model T is priced at approximately $169.99.

3. Tangem Wallet

Tangem Wallet, launched in 2017, is a self-custodial cold hardware wallet designed to look like a standard bank card, easily fitting into a cardholder. It supports storing, buying, selling, earning, transferring, and swapping thousands of coins and tokens, providing comprehensive management of digital assets. The wallet emphasizes security as a priority, featuring a hacking-resistant chip that ensures the safety of stored cryptocurrencies. It operates through a simple interface by interacting with NFC-enabled smartphones, requiring only the Tangem card and the Tangem app to manage transactions. This portable and user-friendly design makes Tangem Wallet an appealing choice for those seeking secure and convenient access to their cryptocurrencies on the go.

4. KeepKey

The KeepKey hardware wallet distinguishes itself with its sleek design and strong security features, supporting over 7,200 digital assets and 348 blockchains. Its large OLED display provides clear transaction details, making the verification process straightforward and enhancing user confidence. KeepKey also integrates with the ShapeShift platform, allowing users to trade cryptocurrencies directly within the wallet, ensuring a seamless and secure experience for both trading and asset management.

In terms of security, KeepKey offers several robust features. Private keys are stored securely on the device, isolated from online threats, ensuring they are never exposed to potentially compromised systems. The wallet is protected by a PIN code, preventing unauthorized access, and users receive a 12-word recovery phrase for wallet restoration in case the device is lost or damaged. Additionally, KeepKey’s open-source firmware allows for continuous security improvements by the community. The device is also tamper-resistant, designed to detect any unauthorized access attempts. With its emphasis on self-custody, KeepKey ensures users maintain full control over their private keys, promoting financial autonomy and security.

5. SafePal S1

SafePal S1 is a cost-effective hardware wallet designed to securely manage a vast array of cryptocurrencies. It supports over 10,000 digital assets, providing users with extensive flexibility in managing their crypto portfolios. The device features a large color touchscreen, simplifying navigation and enhancing the overall user experience.

A standout aspect of SafePal S1 is its commitment to security through complete offline operation. The wallet functions without Bluetooth, Wi-Fi, or USB connectivity, effectively minimizing potential online threats. Instead, it utilizes QR code scanning for transaction signing, ensuring that private keys remain isolated from internet-connected devices.

To manage assets, users can employ the SafePal app, which facilitates interaction with platforms like Binance DEX, enabling seamless trading and asset management. This integration offers a convenient solution for users seeking to securely store and actively manage their cryptocurrencies.

Priced at $49.99, SafePal S1 presents a budget-friendly option for individuals desiring robust security features without incurring significant expense. Its combination of affordability, extensive asset support, and stringent security measures makes it an attractive choice for both novice and experienced cryptocurrency users.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

Best Crypto Cold Wallet: Comparative Table

| Wallet Name | Supported Cryptocurrencies | Key Features | Price (USD) | Security Features | Ideal For |

| Ledger Nano X | Over 5,500 coins and tokens | Bluetooth connectivity; built-in battery; supports up to 100 crypto apps; integrates with apps like MetaMask and Mycelium | $149 | Advanced security with private keys stored offline; PIN protection; Bluetooth encryption | Users seeking a versatile, mobile-friendly wallet with extensive asset support and app integrations |

| Ledger Nano S | Over 5,500 coins and tokens | USB connection; supports 3 to 6 apps at a time; affordable and highly secure | $79 | Private keys stored offline; PIN code protection; recovery phrase backup | Users wanting a secure and affordable hardware wallet without Bluetooth functionality |

| Trezor Model T | Over 1,000 digital assets | Full-color touchscreen; supports password management, U2F authentication; advanced security features | $169.99 | PIN code protection; passphrase support; recovery seed backup | Crypto investors seeking a versatile hardware wallet with enhanced security and identity management tools |

| KeepKey | Over 7,217 coins and 348 blockchains | Large OLED display; integration with ShapeShift for in-wallet crypto trading | $49 | Private key protection; PIN code; recovery phrase; tamper resistance | Users who value both style and security, with the convenience of direct trading within the wallet |

| SafePal S1 | Over 10,000 cryptocurrencies | Large color touchscreen; fully offline (no Bluetooth, Wi-Fi, USB); QR code transaction signing | $49.99 | Air-gapped operation; tamper resistance; private key stored offline | Budget-conscious users who want strong security with complete offline functionality |

How Do Cold Wallets Work?

Here’s a deeper dive into how an average cold wallet functions to keep your assets safe.

- Key Generation. At the heart of every crypto wallet is a pair of cryptographic keys: a public key, which is shared and used to receive funds, and a private key, which remains secret and is used to sign transactions and access funds. A crypto cold wallet starts with the generation of these keys, typically using a random number generator. This ensures a high level of unpredictability and security.

- Offline Environment. The most distinguishing feature of cold storage is its disconnection from online networks and, by extension, from potential online threats. Its offline nature ensures that hackers and malware cannot access the private keys on the cold storage device. In essence, it builds a physical barrier between your digital assets and potential online threats.

- Transfer of Funds. When a crypto investor wants to store their digital assets in cold storage, they send them to the public address associated with their cold wallet. Since only the public key is needed to deposit funds, this transaction can be made securely without exposing the private key.

- Accessing and Transferring Funds. To spend cryptocurrencies or transfer them out of cold storage, one needs to sign the transaction with the private key. This process typically involves connecting the cold storage device to a computer or using the physical wallet in conjunction with a software interface. Once the transaction is signed, the device can be disconnected, and the transaction is broadcasted to the blockchain networks, keeping the private key offline and safe.

- Physical Security. Since the crypto cold wallet is a physical device, you must keep it safe from physical threats like theft, water, or fire. Some cold storage devices come with additional security features, like pin codes or biometric scanners, to ensure that even if someone physically accesses the wallet, they can’t extract the private key.

- Encrypted Protection. Many cold storage devices encrypt the private key, ensuring that even if the device is compromised, the data remains unreadable without the proper decryption key or method.

In summary, the primary function of a crypto cold wallet is to keep the private key—the gateway to your digital assets—offline and safe from both online and offline threats. It’s an essential tool for any crypto investor prioritizing the safety of their investments.

Hot Wallets vs. Cold Wallets

Hot wallets (or software wallets) are digital wallets that store and manage cryptocurrencies while being connected to the internet. They provide users with easy access to their digital assets, making them ideal for everyday transactions, trading, and other activities that require quick access to funds. These online wallets can come in the form of a website, a desktop or mobile app, or a browser extension.

Advantages:

- Convenience. Hot wallets allow users to access and manage their cryptocurrencies quickly and easily, making them suitable for daily use.

- Ease of use. Hot wallets typically feature user-friendly interfaces, allowing both beginners and experienced users to manage their assets effortlessly.

- Integration with platforms and services. Most hot wallets can be integrated into popular crypto exchanges, dApps, and other services, providing seamless access to various features and functions.

Risks:

- Security. Since hot wallets are always connected to the internet, they are more vulnerable to hacks, phishing attacks, and other cyber threats compared to cold wallets.

Cold wallets (also known as offline wallets) store your crypto assets without being connected to the internet. This substantially reduces the risk of theft and hacks, making cold wallets a more secure option for long-term storage or large amounts of cryptocurrency.

Advantages:

- Security. Cold storage wallets store private keys offline, significantly diminishing the risk of theft.

- Long-term storage. This type of wallet is ideal for storing large amounts of cryptocurrency for extended periods, providing peace of mind for investors.

Risks:

- Accessibility. Cold wallets can be less convenient for daily transactions and trading because they require additional steps to access and manage your funds.

- Cost. Some cold wallets, particularly hardware crypto wallets, can be expensive, their prices ranging from $50 to $200 or more.

Nowadays, many cold wallets offer hot wallet-compatible interfaces, bridging the gap between the convenience of hot wallets and the security of cold wallets. These interfaces allow users to manage their cold-stored assets more conveniently while maintaining a high level of security.

For example, hardware wallets like Ledger and Trezor provide companion apps that can be used on the desktop or mobile devices. These apps offer a user-friendly experience similar to hot wallets, while private keys remain securely stored in the hardware wallet. This hybrid approach brings users the best of both worlds, combining the accessibility and ease of use of hot wallets with the enhanced security of cold wallets.

Are cold wallets 100% safe?

No, a cold wallet is not 100% safe, though it is one of the most secure options for storing cryptocurrencies. While cold wallets offer excellent protection by keeping private keys offline and away from internet threats, they are still vulnerable to certain risks.

How to Set Up a Cold Wallet

Setting up a cold storage wallet can be a straightforward process, but it varies depending on the type and model of offline wallet. In general, you’ll need to follow these steps:

- Choose a cold wallet type (hardware or paper wallet).

- Purchase or create the wallet.

- Generate a pair of private and public keys.

- Securely store your private key (often in the form of a seed phrase).

- Transfer your cryptocurrencies to your cold wallet’s public address.

Types of Offline Wallets: Hardware vs. Paper vs. Sound

There are two primary types of offline wallets: hardware and paper crypto wallets. Each has its advantages and disadvantages, and understanding the differences can help you choose the best option for your needs.

Hardware Wallets

Hardware wallets are physical devices that securely store your private keys offline. They often resemble USB drives and are specifically designed to provide a secure environment for your digital assets. Some popular hardware wallets include Ledger, Trezor, and KeepKey.

Advantages:

- High level of security. Since private keys are stored offline, hardware wallets are less susceptible to hacks and online attacks.

- User-friendly. Many hardware wallets come with intuitive interfaces and companion apps, making it easy to manage your cryptocurrencies.

- Compatibility. Hardware wallets usually support a wide range of cryptocurrencies, making them suitable for users with diverse portfolios.

Disadvantages:

- Cost. Hardware wallets can be expensive, with prices ranging from $50 to $200 or more.

- Physical vulnerability. Like any physical device, hardware wallets can be lost, damaged, or stolen.

Paper Wallets

Paper wallets are physical printouts of your public and private keys, often in the form of QR codes. They provide a simple and cost-effective way to store your cryptocurrencies offline.

Advantages:

- Cost-effective. This type of wallet is inexpensive to create, often requiring only a printer and a piece of paper.

- Secure. As long as the private key remains hidden and the paper wallet is stored safely, paper wallets can provide a high level of security.

Disadvantages:

- Limited compatibility. Paper wallets usually support only one type of cryptocurrency.

- Inconvenience. To access your funds, you need to import the private key into a software wallet, which can be a cumbersome process.

Sound Wallets

Sound wallets represent another unique type of offline crypto storage, utilizing audio technology to secure digital assets. These wallets encrypt and convert your private keys into sound files, typically in the form of a series of audible tones or even QR codes that can be read by audio equipment. The private key information is then stored on a medium such as a vinyl record, CD, or other audio storage device.

Advantages:

- Innovative Security: By storing private keys as sound, sound wallets provide a novel form of security that is distinct from traditional digital or paper formats.

- Physical and Digital Security: While being stored physically, the actual data remains digital until decoded, offering a hybrid approach to securing your crypto assets.

Disadvantages:

- Complexity: Sound wallets may seem more complex than other forms of cold storage. Users must have the necessary technology to encode and decode the sound files securely.

- Accessibility: To access funds stored in a sound wallet, one needs specific audio playback equipment and knowledge about converting the audio back into a usable private key, which may not be practical for everyday use.

There’s also an additional type of cold storage wallet called deep cold storage. It refers to an extremely secure method of storing crypto assets and involves creating a new wallet offline, generating private keys on an air-gapped device (a device that has never been connected to the internet), and securely storing the private keys or seed phrases in multiple locations. This can include using physical vaults, safe deposit boxes, or other highly secure facilities. In some cases, users may also opt to split their seed phrases or private keys into multiple parts, storing each part in a separate location to further mitigate the risk of theft or loss.

Keeping private keys or seed phrases in deep cold storage helps seriously reduce the risk of unauthorized access or hacking. However, the trade-off is a lowered level of convenience, as accessing the funds stored in deep cold storage can be a more complicated and time-consuming process. As a result, deep cold storage is generally recommended for long-term storage of large amounts of cryptocurrencies rather than for frequent transactions or trading.

Can a Cold Wallet Be Hacked?

Yes. While cold storage methods are among the most secure ways to store cryptocurrency, they are not completely impervious to all forms of attack. The risks, however, are significantly lower compared to online or mobile wallets on Android and iOS devices. The most common way a cold wallet could be compromised is through physical access. If someone gets their hands on your hardware wallet and knows or can guess your PIN or other security measures, they might access your funds.

However, remote hacking of a cold wallet is extremely challenging as it is not an online wallet and thus lacks a constant Internet connection. The vulnerabilities often arise not from the wallet itself but from user error or security oversights. This could include using a compromised computer to set up the wallet, failing to securely store the recovery seed, or falling for phishing scams.

A notable example of a remote threat occurred in 2023 when the Ledger ConnectKit, a software component used by several decentralized finance (DeFi) applications, was compromised. Attackers inserted malicious code into Ledger’s ConnectKit library, enabling them to drain wallets when users connected to affected DeFi platforms like SushiSwap and Zapper. This incident underscores the importance of secure software practices and cautiousness when interacting with third-party applications and services. While the hardware wallets themselves were not directly hacked, the software used to interact with them was, leading to significant financial losses.

Most cold wallets come packed with robust security features to minimize these risks, but it’s crucial to follow best practices for setup and ongoing use. Regularly updating the wallet’s firmware, using strong, unique PINs, and never sharing your recovery seed or private key are key steps in ensuring the security of your digital assets.

FAQ

What is the best crypto wallet for beginners?

Generally, hot storage options would be the best choice for beginners. Typically free, they often don’t even require you to enter an email address. All you need to do is write down your recovery phrase and come up with a password for the app you’re using.

If you’re looking for the best crypto wallet app for beginners, check out Exodus wallets or MetaMask. And if you’re just making your first steps in the crypto world, you can go for a custodial wallet (a crypto wallet built into a cryptocurrency exchange like Binance) — just keep in mind that it is not a very secure option, even if you go for the safest crypto exchange on the planet.

Is there a free cold Bitcoin wallet?

The only “free” cold wallet device you can get is a piece of paper. Most hardware devices cost money and would typically set you back around $100.

What happens if I lose my hardware wallet? Can I save my crypto?

Losing a hardware wallet can be a distressing experience, but it’s important to remember that your cryptocurrencies are not stored in the wallet itself—they’re on the blockchain. Your hardware wallet merely holds the private keys granting access to your crypto. As long as you have the recovery seed (a series of words generated when you first set up your wallet), you can restore your wallet’s contents on a new device. This recovery process is a fundamental feature of most hardware wallets, making them a secure yet recoverable option for crypto storage.

This aspect underscores the non-custodial nature of such wallets. Unlike online wallets or mobile wallets accessible on Android and iOS devices, where the service provider may have ways to help you recover your account, the responsibility of keeping the recovery seed safe with hardware wallets lies solely with you. Therefore, it’s crucial to store your recovery seed in a secure and private location separate from your hardware device.

Remember, anyone with access to your recovery seed can access your funds, so treat it with the same level of security as you would a credit card or other sensitive financial information.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.