While many crypto users believe in a cashless and fiatless world, it is yet to come. Most of us still have to perform a lot of transactions using good ol’ cash, including BTC and other crypto purchases.

No matter whether you need a fiver for a cup of coffee or want to top up your Bitcoin wallet without having to go through a centralized bank, crypto ATMs can be of great help to anyone looking to convert their crypto to cash and vice versa.

Hi, I’m Zifa, a crypto enthusiast and writer for over 3 years. Today, I’ll show you how to use a Bitcoin ATM, step by step. Let’s get started!

What Is a Crypto ATM?

A Crypto ATM, short for cryptocurrency automated teller machine, is a kiosk or terminal that enables users to buy and sell cryptocurrency using cash or a debit card. Functioning similarly to traditional bank ATMs, these machines provide a convenient way for individuals to engage in cryptocurrency transactions and access their digital assets.

Crypto ATMs operate by connecting users to reputable cryptocurrency exchanges, linking their cryptocurrency wallets, and facilitating the transfer of funds. While most Crypto ATMs allow users to purchase various cryptocurrencies like Bitcoin, Ethereum, and Litecoin, it’s important to note that not all ATMs support the sale of these digital assets.

Crypto ATMs have gained popularity and are available worldwide in numerous locations, such as shopping centers, airports, and convenience stores. However, their availability may vary depending on the region or country due to regulatory constraints or limited market demand.

What Is a Bitcoin ATM?

A Bitcoin ATM does exactly what its name suggests — it is a traditional ATM that accepts BTC and other crypto coins and tokens instead of fiat currencies and cash. It is also sometimes called a Bitcoin Teller Machine, or BTM. Buying Bitcoin this way is as easy as depositing cash to your bank card using traditional ATMs.

Most Bitcoin ATMs allow users to both buy and sell Bitcoin, but not all of them: don’t forget to check whether the ATM you’re planning to use offers your desired functionality. You can also use crypto ATMs to send BTC to another user’s Bitcoin wallet — just enter their address in the recipient field.

While these ATMs are designed to be secure and keep your funds safe, there are still some risks associated with using them to sell and buy Bitcoin.

- Bitcoin transactions are irreversible due to the nature of blockchain technology, so you need to be extra careful when entering all your personal data, such as your Bitcoin wallet address.

- There are a lot of different Bitcoin ATM operators out there, and some can be less… honorable than others. Do not pay for any extra goods or services offered by the ATM operator, and try to check out the reviews for that particular ATM if it’s run by a company you’ve never heard of before.

- Just like when using fiat ATMs, pay attention to your surroundings: while there won’t be a credit card for anyone to grab out of your hand, thieves can still take your money, steal your personal information, and so on.

How Do Bitcoin ATMs Work?

Bitcoin ATMs don’t look all that different from fiat ones. However, they operate in a completely different way: instead of being connected to a bank, they communicate directly with the Bitcoin blockchain.

In order to buy and sell Bitcoin using a crypto ATM, you will only need two things: a digital wallet and a traditional one. Just insert some bills into the machine and then scan the QR code for your digital wallet or enter its address manually — this is all you need to buy Bitcoin using a Bitcoin ATM.

The cryptocurrency you get from a Bitcoin ATM is sent from the wallet of its operator company.

How to Use a Bitcoin ATM

Although Bitcoin ATMs may seem a bit unusual at first, they are easy to use.

https://www.youtube.com/watch?v=UpBPwcPQVD4

Step 1 – Get a Crypto Wallet

The first step to performing any crypto transaction is getting a wallet that supports the coin or token you want to buy. It can be a paper wallet, a digital wallet, or a hardware one — its type doesn’t matter as long as it can send and receive digital money and is secure.

Step 2 – Prepare Your Bitcoin Wallet

Most Bitcoin ATMs (Bitcoin Teller Machines) allow you to use QR codes to make Bitcoin transactions. Check whether your digital wallet offers that feature — after all, it can reduce one’s stress by eliminating the need to enter a long and non-human-readable wallet address.

Step 3 – Find a Bitcoin ATM Near You

Cryptocurrencies are not widely accepted yet, so the chances of you running into a Bitcoin ATM out in the wild are rather slim, especially if you don’t live in a big city like London or NYC. The easiest way to find Bitcoin ATMs located near you is to use live maps like Coin ATM Radar, Bitcoin ATM Map, and others.

Most of these websites, such as Coin ATM Radar, allow you to look for ATMs by proximity, operator, fee, and other parameters.

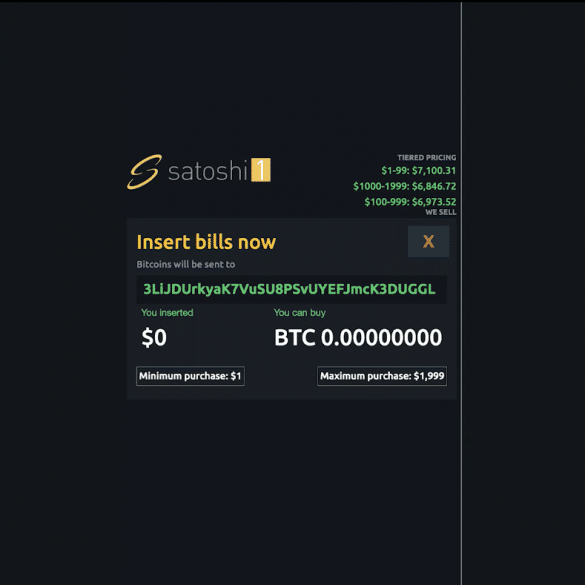

Step 4 – Set Up Your Transaction

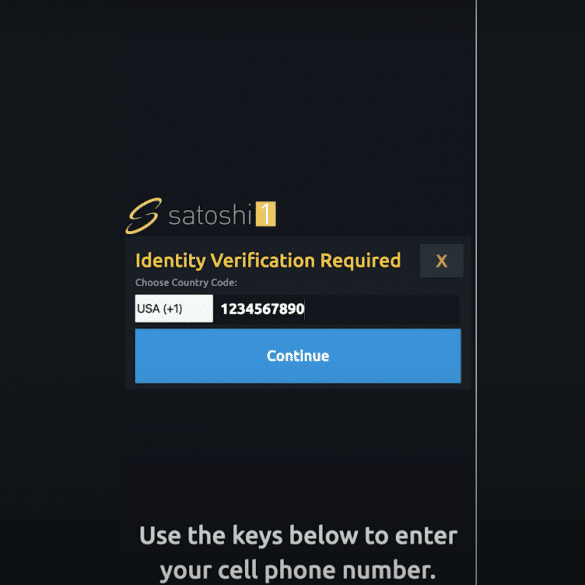

To use a Bitcoin ATM, you will first need to verify your identity.

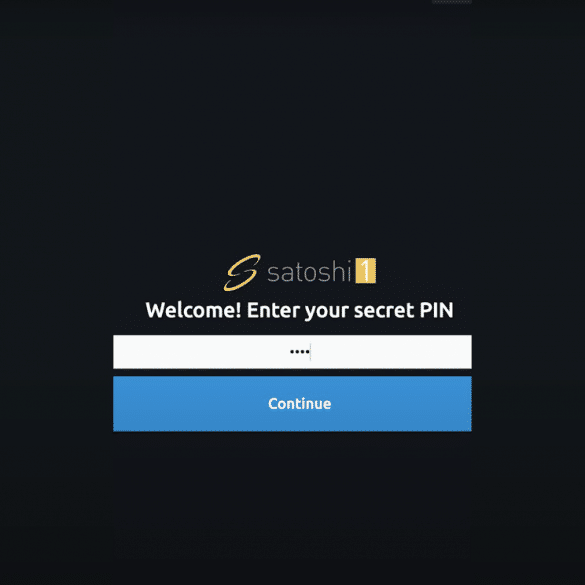

Once that’s done, you’ll need to enter your PIN.

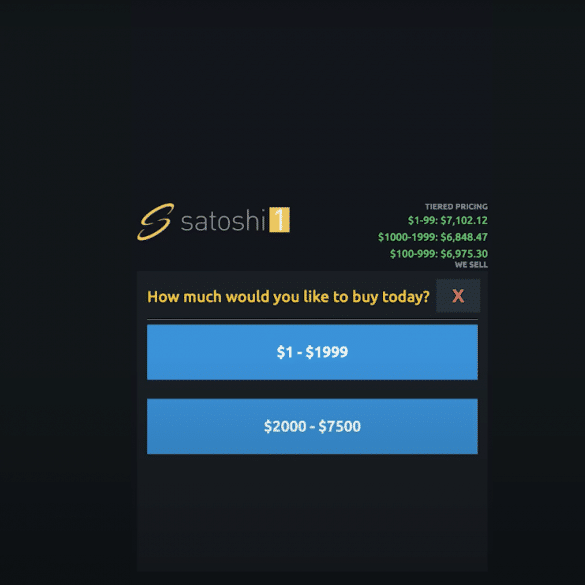

Next, choose the cryptocurrency you would like to get (if the ATM offers more than one) and enter the amount you’d like to purchase.

Step 5 – Enter Your Wallet Information

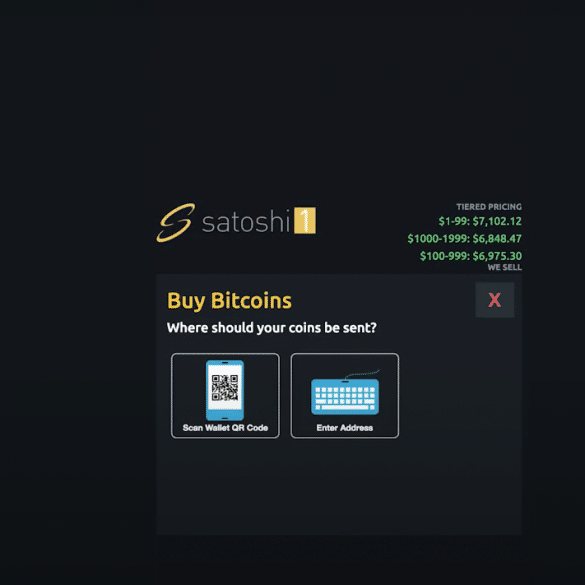

Once you’ve set up your transaction, you will need to enter your Bitcoin wallet address. Most ATMs allow you to use QR codes to minimize the risk of sending your new crypto to the wrong wallet address. If you choose not to go with the QR code option, please remember to double-check the address you entered.

Step 6 – Insert Cash

Double-check all transaction info and insert the required amount of cash into the ATM.

Step 7 – Confirm the Purchase

That’s it! Confirm the purchase and wait for your new cryptocurrency to arrive in your wallet. Delivery times depend on the cryptocurrency you’re purchasing but usually range from 10 to 15 minutes.

Bitcoin ATM Fees

Bitcoin ATM operators have different policies for transaction fees. Typically, there is a flat fee for each transaction and a percentage fee based on the amount sent or received. These fees can vary depending on the provider and your location, generally ranging from 10% to 23%. Some fees can be quite high, so it might be worthwhile to travel a bit further to find an ATM with lower fees.

As cryptocurrencies become more widely accepted, the number of active Bitcoin ATMs is likely to increase, and the fees will probably go down. Until then, we recommend using ATM finders that sort ATMs by fees.

Benefits of Using a Bitcoin ATM

Why do people opt for crypto ATMs? Here are the benefits BTC ATMs offer over traditional cryptocurrency exchanges.

Convenience

Bitcoin ATMs offer immediate access to cash, making them highly convenient for users. They allow instant conversion of digital currencies to cash, unlike traditional exchanges that might require linking bank accounts and waiting for fund transfers.

Additionally, their growing ubiquity means you can find these ATMs in various convenient locations like shopping centers, gas stations, and airports. Operating 24/7, they cater to users at any time, mirroring the always-available nature of auto-teller machines.

Quick Transactions

One of the standout features of Bitcoin ATMs is the ability to reserve cash in advance for withdrawals, ensuring quick access when users arrive. Transactions are almost instantaneous, significantly reducing wait times compared to traditional banking methods. With their increasing number worldwide, Bitcoin ATMs are becoming more accessible, offering a swift means for cash transactions and withdrawals.

No Bank Account or Identification Required

For smaller transactions, many Bitcoin ATMs don’t require identification, making them accessible even without a bank account. This feature is particularly useful for low-risk transactions. However, for larger transactions, identification may be required to comply with AML and KYC regulations. Users typically verify their identity through a phone number, which is confirmed via SMS.

Familiar Process

The familiar format of traditional ATMs is leveraged in Bitcoin ATMs, making them more approachable for users. Placed in strategic, high-traffic locations, they offer a simple and straightforward way for people to buy Bitcoin. This familiar setup can help attract new crypto investors, offering a convenient entry point into the crypto market without the complexities of traditional exchanges.

Privacy

Privacy is a key aspect of Bitcoin ATMs, appealing to those who value financial discretion. Users can enhance privacy by choosing ATMs that don’t require identity verification and using Bitcoin wallets with privacy features. While they offer more anonymity than online exchanges, complete privacy isn’t always guaranteed due to potential security measures like cameras or mobile phone number verification.

Risks of Crypto ATMs

While crypto ATMs provide convenience and accessibility, they are not without risks.

High Fees

Bitcoin ATMs often have higher fees compared to other financial services. These fees cover the costs of operating physical machines, including hardware maintenance, renting space, and providing customer support. Traditional banks, benefiting from more established infrastructures and a broader range of services, can keep their fees relatively lower. Similarly, online crypto exchanges typically have lower fees than Bitcoin ATMs, as they avoid the overheads associated with physical machines and benefit from larger scale operations. They also tend to have lower blockchain transaction (or gas) fees.

Funds Not Insured

Another significant risk with cryptocurrency ATMs is the lack of insurance for funds. Unlike traditional banks where deposits are insured, cryptocurrencies in ATMs don’t enjoy this protection. This leaves users exposed to losses from security breaches or technical failures. Additionally, many cryptocurrency ATMs lack anti-theft measures found in traditional ATMs, such as surveillance cameras, which increases the risk of theft. The absence of dedicated customer support can also be challenging, leaving users to deal with issues like transaction errors on their own.

Transaction Limits

Transaction limits at Bitcoin ATMs vary. Operators may set predefined limits or adjust them based on customer needs. Larger transactions usually require Know Your Customer (KYC) verification to comply with anti-money laundering regulations. Some ATMs offer tiered verification levels, allowing users to increase their transaction limits by providing more information, like linking a bank account.

Availability

Bitcoin ATMs, though growing in number, are less widespread than online exchanges. As of November 2023, there are around 39,000 Bitcoin ATMs globally, a small figure considering the global population. In contrast, online exchanges are accessible to anyone with an internet connection, offering a more extensive range of options and faster setup for trading Bitcoin.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

How are Crypto ATMs Regulated?

The regulation of cryptocurrency ATMs is a complex and evolving aspect of the financial landscape, influenced by a combination of international, federal, and state laws. In the United States, the operation of these ATMs falls under the jurisdiction of the Financial Crimes Enforcement Network (FinCEN). Operators are required to register as money services businesses in compliance with the Bank Secrecy Act (BSA), which demands a robust Anti-Money Laundering (AML) program, including filing Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) for certain transactions. The Patriot Act further supplements this framework with stringent Know Your Customer (KYC) procedures, particularly for transactions above specified thresholds.

On the state level, Crypto ATM operators often need a money transmitter license, adhering to specific state regulations and consumer protection laws. These can include the transparent disclosure of fees and exchange rates and the protection of consumer data. Local ordinances may also impact Crypto ATM operations, including zoning laws and specific operational requirements.

Internationally, regulatory approaches can vary. A notable example is the U.K., where the Financial Conduct Authority (FCA) has recently intensified efforts to regulate cryptocurrency ATMs. In a significant move, the FCA has been cracking down on unregistered crypto ATMs, citing concerns over money laundering. This aligns with the broader regulatory policy in the U.K., where all cryptocurrency-related companies are required to register with the FCA, ensuring compliance with AML standards and other regulatory measures.

This intricate regulatory tapestry, comprising both national and international rules, highlights the ongoing efforts to balance innovation in the cryptocurrency sector with the need for financial security and consumer protection.

A quick look back at Bitcoin ATMs

Let’s take a moment to reflect on the interesting history of Bitcoin ATMs, a significant development in the cryptocurrency world. It all started in 2013 in North America – in Vancouver, Canada, where the first operational Bitcoin ATM appeared. This innovative machine simplified the process of exchanging cash for Bitcoin, making cryptocurrencies more approachable and user-friendly.

Shortly after its debut in Vancouver, Bratislava, Slovakia, embraced the trend by installing its first Bitcoin ATM in 2014. This expansion showcased the widespread interest in such digital solutions, highlighting the ease of buying and selling Bitcoin with traditional currency.

In 2014, the United States joined in. The first Bitcoin ATM in the U.S. was set up in Albuquerque, New Mexico. This was an exciting step forward for American cryptocurrency enthusiasts, signaling a new level of accessibility.

The Future of Bitcoin ATMs

The future of Bitcoin ATMs largely depends on the further development of the crypto industry. As Bitcoin and other cryptocurrencies become more popular and, even more importantly, more widely accepted as a payment method by various businesses and services, the number of cryptocurrency ATMs you see on the streets will also increase.

There is always a possibility that ATMs, in general, may become obsolete in the future, but we don’t think that’s a likely scenario — at least, not for the next 5 or 10 years.

Having studied the cryptocurrency ATM market, various researchers came to the conclusion that it is going to see significant growth in the next few years. Experts from Allied Market Research, for example, predict that this industry is likely to grow at a CAGR (compound annual growth rate) of 58.5% each year from 2021 to 2030.

And if you can’t bear to wait until Bitcoin ATMs become commonplace and get all the perks that come with widespread popularity, you can always buy, exchange, and sell Bitcoin and other cryptocurrencies on our instant exchange instead.

FAQ

What is the best Bitcoin ATM to use?

Choosing the best Bitcoin ATM largely depends on your location and specific needs. To find a Bitcoin ATM near you, the most effective method is to use live mapping services like Coin ATM Radar or Bitcoin ATM Map. These platforms are incredibly user-friendly and allow you to search for ATMs based on various criteria such as proximity, operator, fees, and more.

Among the top crypto ATM operators, you might come across names like Coinstar Bitcoin Machines, known for their widespread presence. Coin Cloud Bitcoin ATM, despite recent financial troubles, is still operational and popular for its user-friendly interface. RockitCoin is another reliable option. For those seeking convenience, Just Cash ATM and LibertyX ATM are standout choices. Additionally, Pelicoin ATM offers reliable services in many locations.

Remember, when choosing an ATM, consider not just the location but also factors like transaction fees, limits, and user reviews to ensure you get the best possible experience.

How do I send money to a Bitcoin ATM?

If you are buying BTC, then you can use cash. If you’re selling Bitcoin, you can use your Bitcoin wallet by either manually entering its address or scanning a QR code.

Do I need an account to use a Bitcoin ATM?

While some Bitcoin ATMs may ask you to create an account, not all of them do so. Most ATMs allow you to start buying Bitcoin after simply entering a text verification code.

Can you put cash in a Bitcoin ATM?

Yes, you can use cash to purchase Bitcoins in your nearest Bitcoin ATM.

How much does a Bitcoin ATM charge for $500?

The amount of Bitcoin you get from converting $500 at a Bitcoin ATM depends on the operator’s fee, which generally ranges from 10% to 23%. With a 10% fee, you would end up with $450 in Bitcoin after the fee is taken out.

Can you withdraw from a Bitcoin ATM?

Absolutely! Bitcoin ATMs provide a convenient way to convert your Bitcoin into cash quickly. For more details, check out our dedicated article on cashing out your BTC here.

Can I send $10,000 through a Bitcoin ATM?

Whether you can send $10,000 through a Bitcoin ATM depends on the limits set by the operator, which usually range from $10 to $10,000. Always check with the specific ATM provider for their exact limits.

Do Bitcoin ATMs require ID?

It depends. Some Bitcoin ATMs may not require ID for smaller transactions, but larger transactions or certain regulations might make identification obligatory. Often, ID is needed when you set up your account or if you exceed an established transaction limit.

Are Bitcoin ATMs safe?

Yes, they are as safe as traditional ATMs and any exchange. This is one of the most frequently asked Bitcoin ATM questions since both crypto and traditional banking ATMs can sometimes be seen as less reliable. However, as long as you look out for things like terminals on top of existing ones or cameras, it should generally be fine. Bitcoin ATMs are designed to be secure and protect your funds, but please always remember to be cautious when using them.

How do I use a Bitcoin ATM with a debit card?

In general, the majority of Bitcoin ATM machines accept cash only. If you can’t find one that lets you purchase Bitcoin with your card, you can use a fiat currency ATM to withdraw cash from your bank account first and use it to buy Bitcoins in a BTC ATM.

How much Bitcoin can you send in a single transaction via a crypto ATM?

Each Bitcoin ATM operator (Bitcoin Depot, Coin Cloud, etc.) has their own limits that you can look up on their websites.

They also usually publish instructions on how to send money through their particular Bitcoin ATM machine.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.